Ethereum Price Prediction: Breaking Toward $5,500 as Institutional Demand Meets Technical Breakout

#ETH

- Institutional Accumulation: Major acquisitions and $20.32B institutional holdings provide strong demand foundation

- Technical Breakout Setup: MACD momentum improvement and Bollinger Band positioning suggest upward potential

- Network Growth: Record transaction volumes and expanding tokenized assets support long-term value appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Consolidation Pattern

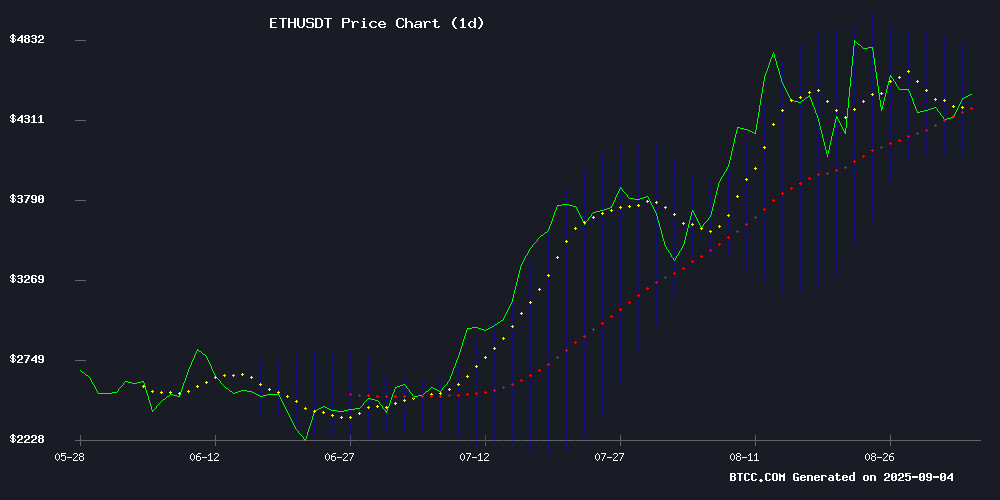

ETH is currently trading at $4,413.11, slightly below its 20-day moving average of $4,442.99, indicating near-term consolidation. The MACD reading of -58.20 versus -81.87 signal line shows improving momentum despite negative territory. Bollinger Bands position the price between $4,077 and $4,810, suggesting room for upward movement toward the upper band resistance.

According to BTCC financial analyst Olivia, 'The technical setup suggests ETH is building a base for potential breakout. The MACD histogram turning positive at 23.67 indicates building bullish momentum, while trading above the lower Bollinger Band support maintains the overall uptrend structure.'

Institutional Demand Fuels Ethereum Optimism

Recent institutional activity, including Bitmine's $358 million ETH acquisition from Galaxy Digital and FalconX, underscores growing corporate confidence. ethereum network metrics show strength with daily transactions hitting 12-month peaks, while institutional holdings reach $20.32 billion.

BTCC financial analyst Olivia notes, 'The combination of institutional accumulation, ETF momentum, and network activity surge creates a fundamentally supportive environment. While whale selling episodes cause short-term volatility, the underlying institutional demand pattern remains strongly bullish.'

Factors Influencing ETH's Price

Bitmine Acquires $358M in ETH from Galaxy Digital and FalconX, Signaling Institutional Demand

Bitmine, the largest corporate holder of Ethereum, has bolstered its position with an additional 80,325 ETH worth $358 million, sourced from institutional platforms Galaxy Digital and FalconX. The acquisition elevates Bitmine's total holdings to 1.94 million ETH, valued at $8.69 billion—more than double the stash of its closest competitor, SharpLink.

The move mirrors MicroStrategy's Bitcoin accumulation strategy, underscoring a growing institutional appetite for crypto assets. Bitmine now controls 1.55% of Ethereum's total circulating supply, potentially exacerbating market tightness as large-scale holders reduce liquid supply.

On-chain data reveals Bitmine's average purchase price of $3,883 per ETH, while SharpLink's holdings were acquired at a slightly lower $3,594. The transaction highlights the pivotal role of institutional intermediaries like Galaxy Digital and FalconX in facilitating block-sized crypto transfers.

Ethereum Price Recovery Faces Resistance at $4,500

Ethereum's price has initiated a recovery wave, climbing above the $4,350 zone, but now faces a critical test at the $4,500 resistance level. The 100-hourly Simple Moving Average and a breached bearish trend line at $4,385 suggest tentative bullish momentum.

A decisive close above $4,500 could pave the way for further gains toward $4,620, while failure to break through may prolong consolidation. Market participants are watching Fib retracement levels closely as ETH struggles to reclaim lost ground.

Whales and Sharks Fuel Ethereum’s Comeback, Price Eyes $4.5K

Ethereum is reclaiming its momentum as large holders accumulate the asset, pushing its price toward $4,500. After a recent dip from its $4,800 peak, ETH is now on an upward trajectory, bolstered by aggressive buying from whales and institutional players.

Santiment data reveals a 14% increase in holdings by 'millionaire' and 'small billionaire' wallets—those holding between 1,000 and 100,000 ETH—over the past five months. This accumulation phase suggests growing confidence in Ethereum's near-term potential.

Analysts like Donald Dean project a breakout beyond $5,000, citing technical patterns and sustained demand. The descending wedge formation, a classic bullish indicator, hints at targets reaching as high as $9,547 if key resistance levels are breached.

Institutional Ethereum Holdings Reach $20.32B, Reflecting Growing Crypto Adoption

Institutional confidence in ethereum continues to surge, with 71 organizations now holding 4.71 million ETH—equivalent to 3.9% of the circulating supply. These holdings, valued at $20.32 billion as of September 2025, underscore Ethereum's entrenched position in global finance as both a reserve asset and digital infrastructure tool.

Bitmine Immersion Tech leads with $8.05 billion in ETH reserves, followed by Sharplink Gaming's $3.61 billion position. The growing participation of gaming firms and technology companies signals broadening institutional adoption beyond traditional financial players.

Ethereum Eyes $5,500 Amid Illiquid Supply Crunch And ETF Momentum

Ethereum's price trajectory remains bullish despite a recent pullback from its all-time high of $4,946. Analysts point to a structural supply shortage, with illiquid holdings dominating the market. The looming possibility of a September rally to $5,500 gains credence from ETF inflows and exchange reserve dynamics.

Binance data reveals a surge in ETH deposits during August's price surge, signaling profit-taking behavior. Yet the broader narrative remains anchored in scarcity—over 75% of circulating supply remains locked in long-term holdings. This illiquidity overshadows minor increases in available tokens, creating a foundation for sustained upward pressure.

Market observers note the delicate balance between short-term sell signals and macroeconomic tailwinds. ETF approvals continue reshaping capital flows, with institutional demand potentially overriding retail profit-taking. The $4,000 level now serves as critical support for the next leg upward.

Ondo Global Markets Launches Tokenized U.S. Stocks on Ethereum

Ondo Global Markets has introduced a groundbreaking initiative to tokenize over 100 U.S. stocks on the Ethereum blockchain. The move mirrors the transformative impact stablecoins had on dollar transactions, now applied to equity markets. This development signals a significant step toward mainstream adoption of blockchain technology in traditional finance.

The tokenized stocks aim to provide the same liquidity and accessibility benefits that digital assets offer to cryptocurrencies. By leveraging Ethereum's infrastructure, ONDO seeks to bridge the gap between conventional markets and decentralized finance.

Ethereum Derivatives Show Resilience Amid Price Pressure

Ethereum's open interest remains steady at $8.4 billion despite a 5.5% weekly price decline, signaling trader confidence in a rebound. Binance data reveals minimal OI contraction (-3.4% in 24 hours), contrasting with typical Leveraged position unwinding during pullbacks.

Spot market activity suggests accumulation, with daily exchange withdrawals exceeding 120,000 ETH across Binance and Kraken. While Binance's Net Taker Volume stays negative (-1.08B to -1.11B), persistent OI levels indicate buyers are absorbing sell pressure rather than capitulating.

Ethereum Network Activity Surges As Daily Transactions Reach 12-Month Peak

Ethereum's on-chain activity has surged to a one-year high, recording 1.8 million daily transactions. This milestone underscores the network's growing utility and the success of its multi-layered scaling strategy.

Nearly 30% of ETH's total supply is now locked in staking, reflecting strong conviction among long-term holders. The trend highlights a shift toward yield generation over selling pressure, reinforcing Ethereum's unique value proposition.

Regulatory clarity from the SEC on liquid staking is fueling speculation about a potential ETH ETF with built-in staking features. Such a development could fundamentally alter institutional capital allocation toward Ethereum.

Ethereum Price Tests Breakout Zone With Bullish On-Chain Signals

Ether's consolidation phase reveals a tug-of-war between bulls and bears, but two critical on-chain metrics suggest an impending upside breakout. The percentage of ETH supply in profit has dropped to 92.7%, indicating potential seller exhaustion. Historically, such levels have preceded rallies—like August's 31% surge following a similar dip.

Short-term holders are accumulating despite recent gains, with their share rising from 10.9% to 13% in two weeks. This unusual behavior during a 20% monthly uptrend suggests stronger conviction among typically profit-sensitive traders. The combination of reduced selling pressure and accumulation at key levels paints a constructive technical picture.

Ethereum Whales Trigger Market Jitters with $32 Million Sell-Off

Ethereum faces heightened volatility as large holders execute strategic sell-offs. A single whale address dumped 7,500 ETH ($32.33 million) on Binance while maintaining a $33 million position, signaling profit-taking behavior during sideways price action.

Simultaneously, another whale deployed $3.25 million USDC to short ETH with 25x leverage on Hyperliquid, setting liquidation triggers at $5,291. These coordinated moves reflect growing bearish sentiment among institutional players.

The market responded with ETH dipping 1.2% to $4,306, testing critical support NEAR $4,260. Traders now watch the $4,415 resistance level, which could determine whether bullish momentum can override whale selling pressure.

Experts Predict Ethereum To Win Big In The New Stablecoin Economy

Ethereum's architectural advantages position it as the foundational LAYER for the emerging stablecoin economy, according to Sanjay Shah, a researcher at Electric Capital. The GENIUS Act's passage has catalyzed a significant price rally, with Ethereum outperforming competitors, surging past $3,500 and peaking at $3,875. At press time, ETH trades at $4,465.

The legislation removes barriers to stablecoin adoption, reinforcing Ethereum's role in global dollar access. Investors are betting on ETH to anchor this financial shift, as stablecoins become central to the monetary system.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH shows strong potential to reach $5,500 in the medium term. The convergence of institutional accumulation, technical breakout patterns, and growing network activity creates a bullish foundation.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $4,800 | High | 1-2 months | Bollinger Upper Band, Institutional Flow |

| $5,200 | Medium | 3-4 months | ETF Momentum, Supply Crunch |

| $5,500 | Medium | 4-6 months | Stablecoin Economy Growth, Network Adoption |

BTCC financial analyst Olivia emphasizes that 'While resistance at $4,500 presents a near-term hurdle, the combination of technical momentum and fundamental tailwinds suggests ETH is positioned for significant upward movement, with $5,500 representing a realistic medium-term target.'